Saving Money on Medicare IRMAA’s Extra Cost

Learn how Medicare IRMAA’s extra cost can be eliminated or reduced for 2024 and future years. IRMAA affects both Part B and Part D.

IRMAA – Basics: What / Why / Who / When

What IRMAA is

IRMAA (Income-Related Monthly Adjustment Amount) is an extra premium added to premiums for Medicare Part B (doctor visits, outpatient care) and Part D (prescription drugs). There is no IRMAA extra premium for Part A (hospital, skilled nursing facility and other inpatient coverage).

Why important

The IRMAA extra premium increases the cost of Medicare coverage. For 2024, IRMAA can add as much as $419.00 monthly to Part B costs, and $81.00 to Part D costs.

Who is Affected

Folks enrolled in Medicare Part B and, or Part D can be affected. Whether coverage is through Original Medicare or Medicare Advantage, an enrolled person is subject to IRMAA when they have Parts B and, or D.

When IRMAA applies

The extra premiums apply when an enrollee’s modified adjusted gross income (MAGI) from their tax return filed two years prior exceeds certain thresholds (see chart below). For example, in 2024 an enrolled person might get IRMAA extra premium charges if their MAGI from two years prior, i.e. 2022, exceeds certain thresholds. In 2025 an enrolled person might get IRMAA extra premium charges if their MAGI from two years prior, i.e. 2023, exceeds certain thresholds.

IRMAA – Figuring Out: MAGI / Thresholds / Premiums

IRMAA MAGI defined

The IRMAA MAGI is the sum of the AGI (adjusted gross income), and tax-exempt dividends and interest reported on a tax return. (Please note that definitions of MAGI can be confusing because many programs specify their own definitions for MAGI. For example, the Net Investment Income Tax’s definition of MAGI is the sum of AGI and excluded foreign earned income.)

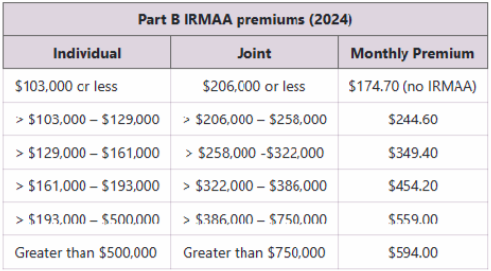

Part B (outpatient) Thresholds and Higher Cost Premiums

For 2024, an enrollee pays $174.70 monthly if their MAGI is at, or below $103,000 for individuals ($206,000 for joint). However, if MAGI exceed those amounts, they might need to pay the IRMAA. The chart below shows the IRMAA at various thresholds. Note that the monthly premium can get as high as $594.00 (the sum of the regular premium of $174.70 and an IRMAA charge of $419.30.

Source: Center for Medicare & Medicaid Services

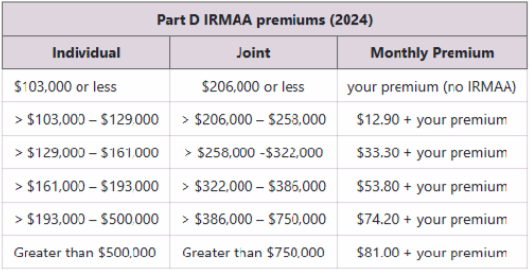

Part D (drugs) Thresholds and Extra Premiums

Similarly, this chart below shows for 2024 the IRMAA extra premiums that are added to Part D monthly premiums when MAGI, as reported on a 2022 tax return, exceeds certain thresholds.

Source: Center for Medicare & Medicaid Services

IRMAA – Getting Notified by SSA / Successful Appeal

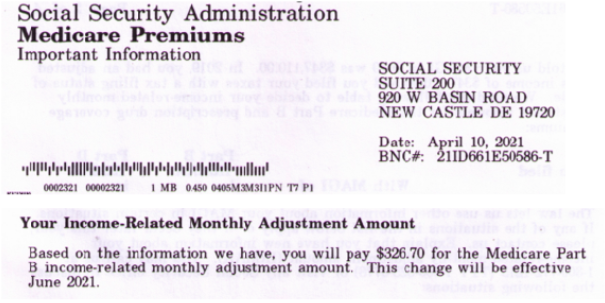

You Might Receive a Letter from SSA

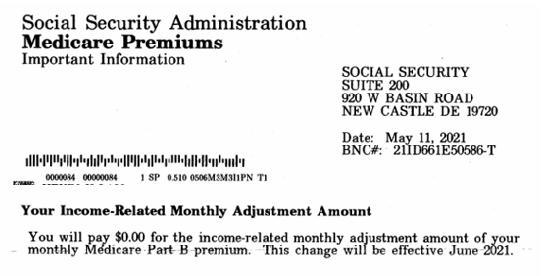

The Social Security Administration (SSA) will mail a letter to an enrollee when it determines IRMAA is required. Here are parts of the letter I received in 2021 informing me my IRMAA would be $326.

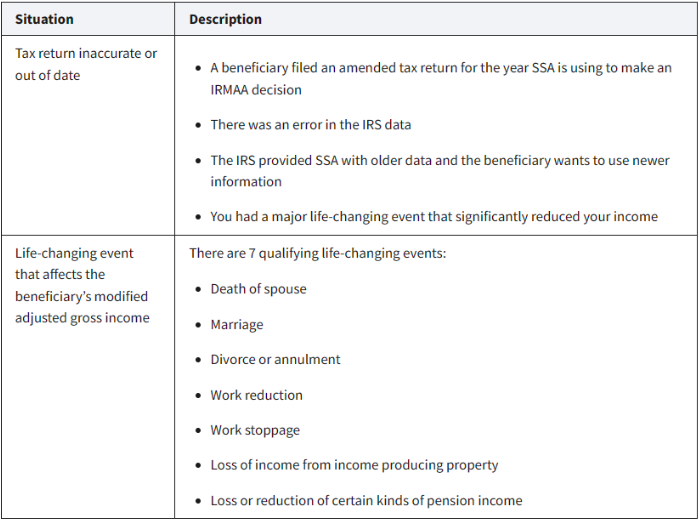

Appealing to the Social Security Administration

You can appeal to the Social Security Administration (SSA) to reduce or eliminate your IRMAA extra premium. Call them at 800-772-1213 or write to them. SSA might adjust your IRMAA if there was wrong information on your tax return or if you had a life-changing event. The situations described in detail below would justify a successful appeal.

Example of a Successful Appeal

I successfully appealed my IRMAA charge. Here’s is the letter I received one month later eliminating my $326 IRMAA.

Events SSA does not accept as basis for an appeal

There are financial events SSA would not accept as a basis for an appeal. Examples include single year increases in taxable income due to:

- Roth conversions

- Cashing out an annuity or life insurance contract worth more than the cost basis

- Selling appreciated stock or other assets

- Selling the family home (to the extent the gains are not excluded by the capital gains exclusion of $250,000 for singles or $500,000 for married couples) or rental property

Planning to Avoid / Minimize Future IRMAA Charges

IRMAA is not a one-time event

Each and every year, SSA will look at an enrollee’s MAGI from two years prior to determine if they would need to pay IRMAA extra premiums.

Take action in the current year to reduce or avoid IRMAA two years from now

SSA will use this current year’s MAGI to determine IRMAA two years from now. Actions you take this year could prevent or reduce future IRMAA charges.

Five strategies to avoid or minimize IRMAA extra premiums two years from now

To avoid or minimize future IRMAA extra premiums, keep MAGI below IRMAA thresholds. Consider:

–making charitable contributions

–offset realized capital gains by harvesting capital losses

–if working, contribute to a tax-deferred account accounts (IRA, 401-k, 403-b, 457-b, Thrift Savings Plan)

–when withdrawing money from an investment account, withdraw from taxable accounts or Roth IRA accounts instead of tax-deferred accounts

–spread out Roth conversions over several tax years

Plan for year-end mutual fund distributions that could unexpectedly boost MAGI

An enrollee should estimate the year-end capital gains and dividend distributions from their mutual funds. Sometimes mutual funds buy and sell securities in their portfolios which result in large capital gains. These gains might cause an enrollee’s MAGI to shoot above a threshold and result in IRMAA extra premiums in the future.

Note that realized capital losses might possibly reduce your MAGI and thus potentially lower your future IRMAA extra premiums.

Additional Notes on IRMAA – Inflation-Indexed / Tax-Deductible

IRMAA thresholds indexed to inflation.

Thresholds are adjusted with changes in the Consumer Price Index. Adjustments are made annually.

Deductibility of IRMAA extra premiums

Taxpayers who itemize deductions may deduct IRMAA extra premiums in addition to Medicare premiums, and other qualifying medical expenses to the extent their sum exceeds the 7.5% AGI floor. Additionally, self-employed taxpayers may deduct IRMAA extra premiums and Medicare premiums as self-employed health insurance premiums.

IRMAA – 3 Summary Takeaways

1-IRMAA extra premiums can significantly increase the cost of Medicare coverage

2-these extra premiums can be appealed and perhaps reduced or eliminated

3-income planning can reduce or avoid future IRMAA charges

About the Author

Kevin Lam, CFP® CPRS™ is an advice-only, flat-fee financial planner based in Wilmington, DE serving clients virtually nationwide. With 45+ years of finance experience, he helps folks age 60+ plan their retirement income, wealth, safety and legacy.

Important Disclosures: Age Wisely Financial, LLC is a registered investment advisor offering advisory services in the States of Delaware, and in other jurisdictions where exempted. Registration does not imply a certain level of skill or training.

The information on this site is not intended as tax, accounting or legal advice, as an offer or solicitation of an offer to buy or sell, or as an endorsement of any company, security, fund, or other securities or non-securities offering. The information on this site should not be relied upon for purposes of transacting in securities or other investment vehicles.

Age Wisely Financial does not warrant that the information will be free from error.

Meet the Author

Kevin Lam CFP® CPRS™

Serving retirees and folks age 60+ in planning their retirement income, wealth, safety and legacy. Helping guide them on their personal finance and life journeys with understanding, wisdom and care. With more than 45 years of finance experience, I am a flat-fee, advice-only financial planner based in Wilmington, DE working with clients virtually nationwide.